Highlights of Obama Jobs Plan

Highlights of Obama Jobs Plan

President Obama's proposals are nonstarters, based on economic non sequiturs, born out of political desperation. They are simply more interventionist lies to cover over the lies of the last failed government intervention. And that, tragically, is "the simple math" of Barack Obama's failed presidency. (Continue reading this story).

◆ EMPLOYEE TAX CUTS. A deeper payroll tax cut for all workers. Congress in December cut the payroll tax, which raises money for Social Security, from 6.2 percent for every worker to 4.2 percent, for all of 2011. Obama’s proposals would cut that tax even further — to 3.1 percent — for all workers in 2012.

◆ EMPLOYER TAX CUTS. A payroll tax cut for all business with payrolls up to $5 million. Obama’s proposal would cut the current 6.2 percent share of the payroll tax that employers pay to 3.1 percent. The White House says 98 percent of businesses have payrolls below the $5 million threshold.

◆ PUBLIC WORKS. The president proposes spending $30 billion to modernize schools and $50 billion on road and bridge projects. He also calls for an “infrastructure bank” to help raise private sector money to pay for infrastructure improvements and for a program to rehabilitate vacant properties.

◆ UNEMPLOYMENT BENEFITS. The proposal would continue assistance to millions of people who are receiving extended benefits under emergency unemployment insurance set up during the recession. That program expired in November but Congress renewed it for 2011. If not renewed again, it would expire at the end of this year, leaving about 6 million jobless people at risk of losing benefits.

◆ LOCAL GOVERNMENT AID. The ailing economy has forced state and local governments to lay off workers. Money that states and municipalities received in the 2009 stimulus package has been running out. Obama proposes spending to guard against layoffs of emergency personnel and teachers. The estimated cost is $35 billion.

◆ EMPLOYER TAX CREDITS. The president proposes a tax credit of up to $4,000 for businesses that hire workers who have been looking for a job for more than six months.

◆ EQUIPMENT DEDUCTION. Obama wants to continue for one year a tax break for businesses, allowing them to deduct the full value of new equipment. Previously, companies could only deduct 50 percent.

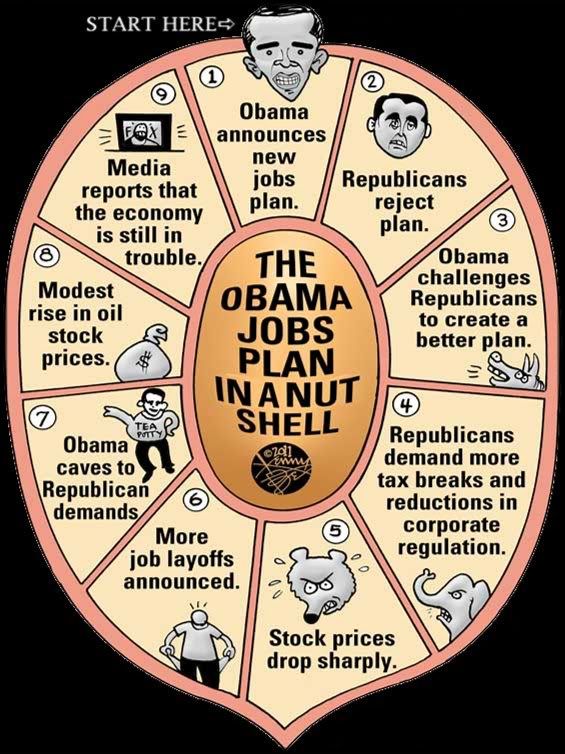

Will President Obama's new jobs plan save the country from a double-dip recession or burden our sliding economy with another $400 billion of deficit spending? Below, an easy-to-read chart explains the president's entire economic stimulus plan in a nutshell...

As illustrated in the nut graph above, President Obama's complex jobs and growth package is really quite simple to understand. Just follow the numbers and repeat. It never ends. (Continue reading this story).

What's your opinion?

Tags: Obama Jobs Plan, Obama, Jobs Plan, Obama Speech, Employee Tax Cuts, Payroll Tax Cuts, Employer Tax Cuts, Public Works, Social Security, Unemployment Benefits, Local Government Aid, Welfare, Entitlement Programs, Employer Tax Credits, Equipment Deduction, Barack Obama, 2012 Elections, President Obama

No comments:

Post a Comment